The Ultimate Property Investment Checklist for Fraser Coast

Your Roadmap to Success

Investing in property is an exciting journey, especially in a vibrant market like the Fraser Coast. To ensure your investment success, it’s crucial to have a solid plan in place. Our Ultimate Property Investment Checklist for Fraser Coast is designed to be your comprehensive roadmap, guiding you through every step of the investment process.

Whether you’re a seasoned investor or just starting, this checklist covers everything you need to know. From assessing your financial readiness to finding the right property and managing ongoing costs, we’ve got you covered. We’ll also delve into the unique aspects of the Fraser Coast market, giving you insights tailored to this dynamic region.

By following our checklist, you’ll be equipped with the knowledge and tools to make informed decisions and maximize your investment potential. Join us on this journey to unlock the doors to property investment success in the beautiful Fraser Coast region.

Developing a Long-Term Investment Strategy with a Dash of Fun and Professionalism

Alright, buckle up, future property mogul! Developing a long-term investment strategy is your ticket to success in the property game. Here’s how to do it with style:

Set Your Goals:

Are you in it for the high rental yields or the slow but steady climb of capital growth? Decide what floats your boat.

Time is Money:

How long are you planning to hang onto this property? Short-term fling or a long-term commitment? Your strategy will vary depending on your answer.

Future-Proof Your Investment:

Think ahead. Are you considering renovations or expansions down the line? Planning now can save you a headache later.

Do Your Homework:

Research, research, research! Know the market trends, rental demands, and potential growth areas like the back of your hand.

Stay Flexible:

The property market can be as unpredictable as the weather. Stay nimble, adjust your strategy as needed, and always be ready to seize opportunities.

Investing in property is like planting a seed. With the right strategy and care, you’ll watch it grow into a lucrative venture. So, roll up your sleeves, get researching, and let’s make some property magic happen! Happy investing!

Location, Location, Location

When considering property investment in Fraser Coast, it’s essential to research the specific suburbs like Urraween, Nikenbah, and Kawungan. These suburbs offer unique advantages for investors:

Urraween

- Location: Urraween is situated just south of Hervey Bay and offers a blend of residential and commercial properties.

- Rental Yields: The suburb has shown steady rental yields due to its proximity to medical facilities like the Hervey Bay Hospital.

- Vacancy Rates: Urraween typically maintains low vacancy rates, making it attractive to investors seeking stable rental income.

- Capital Growth: With ongoing development and infrastructure improvements, Urraween shows promise for future capital growth.

- Amenities: Residents enjoy access to schools, shopping centers, and medical facilities, enhancing its appeal for families and professionals.

Nikenbah

- Rural Charm: Nikenbah retains its rural charm while being close to the amenities of Hervey Bay.

- Population: The locality had a population of 657 in the 2016 census, offering a close-knit community atmosphere.

- Investment Potential: While currently more rural, Nikenbah’s proximity to Hervey Bay and surrounding areas suggests potential for future growth and development.

Kawungan

- Convenience: Kawungan is conveniently located near Hervey Bay’s central business district, offering easy access to amenities.

- Schools: The suburb is home to several schools, making it attractive to families.

- Rental Demand: With its proximity to amenities and schools, Kawungan experiences consistent rental demand, ensuring stable rental income for investors.

- Capital Growth: The suburb’s proximity to key facilities and ongoing development projects bodes well for potential capital growth.

And here’s the real kicker:

Hervey Bay, has been on the express train to growth-town for the past two decades! Reports are buzzing with a population rocketing between 2.7% and 4%, and a whopping 70,000 locals calling Hervey Bay home.

Investing in these suburbs requires a thorough understanding of the local market dynamics, rental yields, and growth potential. Consider consulting with local real estate experts for a comprehensive analysis before making investment decisions.

Check out the stats for yourself HERE

Getting Financially Ready for Your Investment Journey

Before diving headfirst into the world of investments, it’s crucial to assess your financial situation. Here’s a step-by-step guide to ensure you’re financially prepared:

Evaluate Your Finances:

Take stock of your income, expenses, assets, and debts. Understanding your financial position will help you determine how much you can comfortably invest.

Factor in Additional Costs:

Don’t forget about the extra expenses associated with investing. Consider costs like stamp duty, legal fees, and ongoing maintenance expenses. These can significantly impact your overall investment budget.

Consult a Financial Advisor:

Seeking advice from a financial advisor can provide you with invaluable insights. They can help you understand your investment options, assess risks, and develop a tailored investment strategy.

Review Your Investment Options:

With the help of your financial advisor, explore different investment opportunities that align with your financial goals and risk tolerance.

Create a Financial Plan:

Based on your assessment and the advice of your financial advisor, create a detailed financial plan that outlines your investment goals, strategies, and timelines.

By following these steps and seeking advice from a financial advisor, you can ensure you’re financially ready to embark on your investment journey. Remember, investing is a long-term commitment, so it’s essential to make informed decisions from the start.

New Build . . . Inspection time

Inspecting a new build for investment requires a different approach. While many aspects of the property will be pristine, it’s crucial to look for any potential issues that could arise. Here are key areas to focus on:

Construction Quality:

Ensure that the construction meets high standards and there are no shortcuts or defects that could lead to future problems.

Warranty and Guarantees:

Check the warranties and guarantees provided by the builder to ensure they cover the property for a reasonable period.

Energy Efficiency:

Assess the property’s energy efficiency features, as they can add value and reduce ongoing costs.

Future Development:

Research any planned developments in the area that could affect the property’s value or rental potential.

Completion Date:

Confirm the completion date and ensure it aligns with your investment timeline and financial plans.

Investing in a new build can offer advantages such as modern amenities, energy efficiency, and less immediate maintenance. However, thorough inspection and research are still essential to make a wise investment decision.

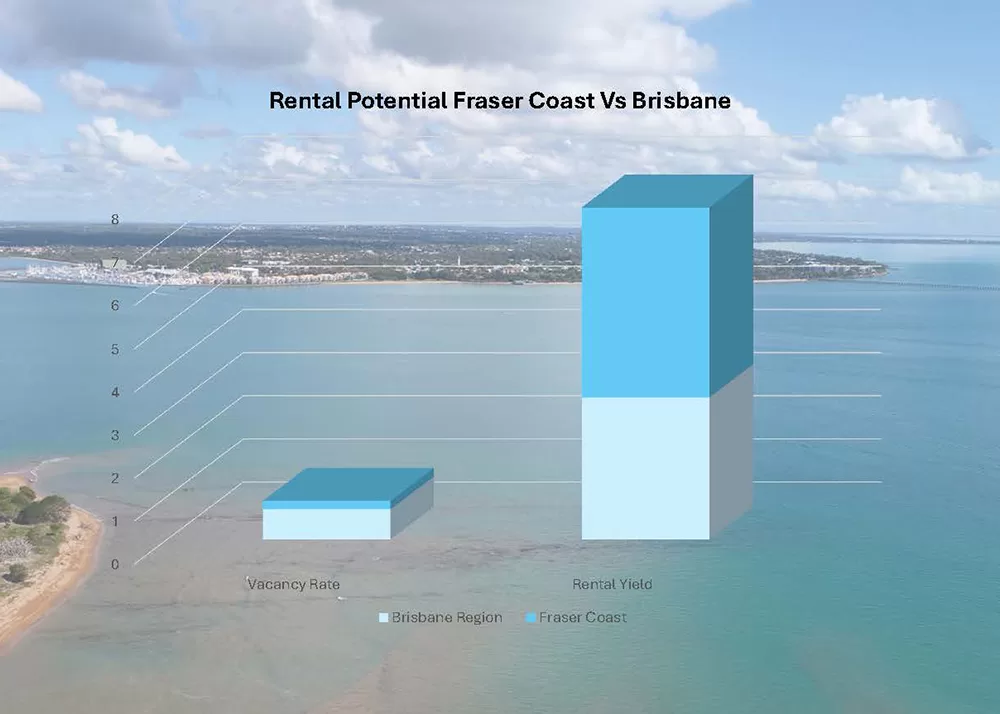

Rental Potential – will the returns be worth it?

When assessing the rental potential of a property in Hervey Bay, it’s important to consider the current rental market trends and data. Here are key points to research:

Rental Prices:

Research the average rental prices for similar properties in Hervey Bay. This will give you an idea of the potential rental income your property could generate. According to a recent report, house rental yields in Hervey Bay were recorded at 4.4% in March 2022, which is higher than Brisbane Metro’s 3.3%.

Vacancy Rates:

Consider the current vacancy rates in Hervey Bay. Low vacancy rates indicate a strong rental market and high demand for rental properties. Despite a higher number of properties rented, Hervey Bay continues to experience a highly demanded rental market, with rental prices increasing.

Tight Rental Market:

The rental market in Hervey Bay is tight, with potential tenants making quick decisions. A well-presented property can attract tenants and maximize rental returns. By researching rental prices, vacancy rates, and market trends, you can ensure that your property in Hervey Bay has the potential to generate sufficient rental income to cover expenses and provide a return on investment.